For a digital signature to be considered legal, it must meet different criteria. The spread of digital tools is leading companies to question their legal value. In this article we look at all the information you need to have to hand if you also want to get started with digital signatures.

Since when has the digital signature been accepted?

Did you know that the electronic signature already has an official legal value in Europe since 2014, with the adoption of the eIDAS regulation? So a company has the right to hold a signatory to a contract or quote that contains a digital signature.

The eIDAS Regulation also clarifies that only a qualified electronic signature has the same legal value as a ‘wet’ signature. More on this below.

The criteria to know that justify the legal value of a digital signature

A digital signature has a legal value if you meet the four criteria established by the European Regulation, which are:

- The document sent must only and exclusively concern the signatory,

- It must identify the signatory,

- It is important that the signatory keeps control when they generate their digital signature,

- Finally, it must be immediately possible for all the stakeholders to detect an amendment to the contract.

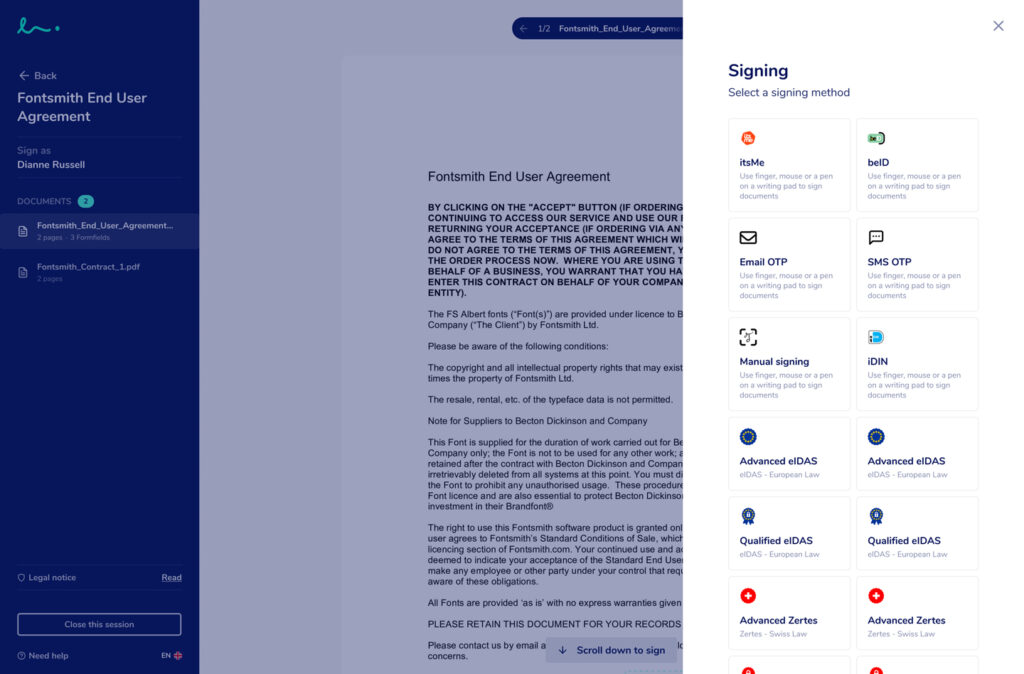

The document sent online cannot be edited during or after signing. Concerning the signatory’s identification, several means are made available to certify that it is in fact this person.

For example, the signatory receives a code on their mobile phone linked to their personal phone number. If they have not entered the code, they cannot read the encrypted document.

A dual identity check can also be made by sending the one-time code to their work email address only.

The three levels of signature accepted by the eIDAS regulation

To date there are three types of digital signature with legal value that are recognised:

The simple signature

It’s the most well-known and used on the market to date. It groups a simple level of security with a digital signature and an identity check that are not necessarily proven.

To give you a concrete example, a digital signature with a delivery person is called a simple signature. This is more a process to ensure the traceability of exchanges and the person’s identity. Logically, you cannot use a simple signature in all fields of activity.

The advanced signature

This is requested immediately as soon as it’s a question of financial transactions or a legal scope is involved. The four signature criteria mentioned above are required to recognise that the digital signature has a legal value.

The qualified signature

This is the signature with the highest level of security, but it’s also the type that has to meet the most requirements and thus won’t always be ideal for every transaction or signature process. That is why it is mostly used in quite specific situations, where the requirements a qualified signature must meet are desired.

If you want to know more about a QES, its requirements and use cases, be sure to check out one of our older blog posts.

Points to remember!

A digital signature only has legal value if it observes the legal scope imposed by the government and/or Europe.

All companies are obliged to meet the identify check criteria and implement the appropriate system according to the type(s) of signature(s) they want to implement.

Questions? Don't hesitate to contact us!